Executive Leadership

At Credit CRB, our leadership team is driven by one mission: to help individuals and businesses gain real financial leverage through stronger credit and smarter funding solution

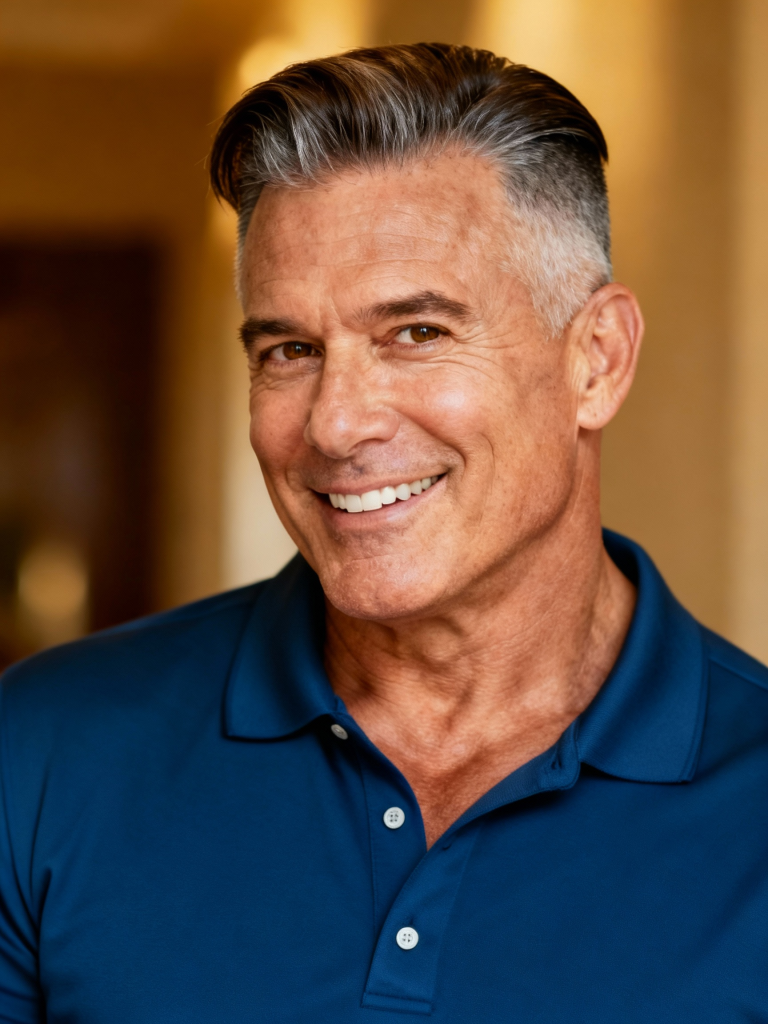

Sam Sky

Chief Executive Officer & Founder, Credit CRB

Sam Sky is the visionary Chief Executive Officer and Founder of Credit CRB, bringing over 23 years of unparalleled expertise in the financial services sector to his leadership role. He established the company with a mission to deliver world-class credit repair and secure low-interest business loans, employing innovative, aggressive, and legally creative strategies. Under his direction, Credit CRB has become a trusted partner for individuals and businesses across all 50 states, known for its results-driven approach to financial empowerment. Mr. Sky has successfully cultivated a robust network of over 2,000 banks, credit unions, and private lenders, ensuring clients gain access to the most favorable financing options available. His strategic focus on both personal and business credit health provides a comprehensive solution that is unique in the industry. He is deeply committed to helping clients, including judges, lawyers, and business owners, achieve financial stability and unlock their borrowing power. Sam Sky’s unwavering dedication to excellence and client success defines Credit CRB’s position as a leader in the financial services landscape.

Board of Directors

Brian Kravitz

VP of Partnering Agreements

Brian Kravitz is the Vice President of Partnering Agreements at CreditCRB, where he is instrumental in forging strategic alliances that expand the company’s reach and service capabilities. He is responsible for identifying, negotiating, and securing mutually beneficial

George Alvarez

VP of Partnering Agreements

Brian Kravitz is the Vice President of Partnering Agreements at CreditCRB, where he is instrumental in forging strategic alliances that expand the company’s reach and service capabilities. He is responsible for identifying, negotiating, and securing mutually beneficial

Gary Carter

VP of Partnering Agreements

Brian Kravitz is the Vice President of Partnering Agreements at CreditCRB, where he is instrumental in forging strategic alliances that expand the company’s reach and service capabilities. He is responsible for identifying, negotiating, and securing mutually beneficial

With deep experience in credit repair, debt negotiation, and business funding, our executives focus on delivering measurable results, not empty promises. Every strategy we implement is built on compliance, transparency, and proven systems designed to move our clients forward.

We believe credit is not just a number, it’s a tool for opportunity, growth, and long-term financial freedom.

Brian Kravitz

VP of Partnering Agreements

Brian Kravitz is the Vice President of Partnering Agreements at CreditCRB, where he is instrumental in forging strategic alliances that expand the company’s reach and service capabilities. He is responsible for identifying, negotiating, and securing mutually beneficial partnerships with financial institutions, referral networks, and other key industry players. Brian’s expertise in cultivating strong relationships ensures that CreditCRB can offer a broader spectrum of solutions, enhancing its value proposition for clients seeking credit repair and business financing. His strategic vision in partnership development is crucial for driving growth and reinforcing CreditCRB’s position as a leader in the financial services sector. He is dedicated to creating collaborative ecosystems that benefit both CreditCRB and its partners, ultimately serving the financial needs of a diverse clientele.

Gary Carter

V.P of Accounting

Gary Carter serves as the Vice President of Accounting at CreditCRB, overseeing all financial reporting, compliance, and fiscal management operations. He ensures the accuracy and integrity of CreditCRB’s financial records, providing transparent insights into the company’s economic health. Gary’s meticulous approach to accounting practices and adherence to regulatory standards are fundamental to maintaining CreditCRB’s financial stability and trustworthiness. His expertise supports strategic decision-making by providing precise financial analysis and forecasting, contributing directly to the company’s sustainable growth. He is committed to upholding the highest standards of financial accountability and efficiency within the organization.

Mary Ellen O'Connell

Director of Business Loans

Mary Ellen O’Connell is the Director of Business Loans at CreditCRB, specializing in connecting small and medium-sized businesses with optimal financing solutions. She leads a dedicated team focused on guiding clients through the complex landscape of business lending, including SBA loans and lines of credit. Mary Ellen’s deep understanding of various loan products and her ability to tailor solutions to individual business needs are critical for client success. Her commitment ensures that businesses receive the capital necessary for growth, even those with challenging credit histories. She plays a pivotal role in empowering entrepreneurs to achieve their financial objectives and expand their operations.

Dee Dee Stallworth

VP of Personal Credit and Business Credit Repair

Dee Dee Stallworth is the Vice President of Personal and Business Credit Repair at CreditCRB, leading the charge in transforming clients’ financial futures. She oversees the development and implementation of innovative strategies for both individual and corporate credit restoration, ensuring aggressive and legal removal of derogatory items. Dee Dee’s profound expertise in credit laws and regulations, combined with a client-centric approach, delivers exceptional results in improving credit scores and financial profiles. Her leadership is vital in upholding CreditCRB’s reputation for excellence and its commitment to empowering clients with financial stability. She is passionate about making a tangible difference in the lives of CreditCRB’s diverse clientele.

Eric Walker

I.T Director

Eric Walker serves as the Vice President of Information Technology at CreditCRB, spearheading the development and maintenance of the company’s robust technological infrastructure. He is responsible for implementing innovative IT solutions that enhance operational efficiency, data security, and client experience across all platforms. Eric’s expertise ensures that CreditCRB leverages cutting-edge technology to deliver seamless and secure services for credit repair and financial solutions. His strategic oversight of IT systems is crucial for maintaining the company’s competitive edge and supporting its rapid growth. He is dedicated to fostering a technologically advanced environment that empowers both employees and clients.

Becca Wadsworth

Becca is the Vice President of Business Loans at CreditCRB, where she plays a critical role in facilitating access to capital for businesses of all sizes. She leads a team dedicated to understanding the unique financial needs of entrepreneurs and matching them with the most suitable low-interest loan products. Becca’s extensive knowledge of the lending landscape, coupled with her commitment to client success, ensures that businesses receive tailored and effective financing solutions. Her efforts directly contribute to the growth and expansion of CreditCRB’s business clientele. She is passionate about empowering businesses to achieve their full potential through strategic financial support.

George Alvarez

V.P of Project Management

George Alvarez is the Vice President of Project Management at CreditCRB, responsible for overseeing the successful execution of strategic initiatives and operational improvements. He ensures that all projects, from new service launches to system upgrades, are delivered on time, within budget, and to the highest quality standards. George’s meticulous planning and leadership are vital in coordinating cross-functional teams and managing complex workflows within CreditCRB. His expertise in project lifecycle management drives efficiency and innovation across the organization. He is dedicated to translating strategic goals into tangible results, enhancing CreditCRB’s overall effectiveness and client satisfaction.

Connie Zoehler

V.P of Training and Development

Connie Zoehler serves as the Vice President of Training and Development at CreditCRB, where she is dedicated to cultivating a highly skilled and knowledgeable workforce. She designs and implements comprehensive training programs that equip employees with the latest expertise in credit repair, financial regulations, and client service best practices. Connie’s commitment to continuous learning ensures that CreditCRB’s team remains at the forefront of the industry, delivering exceptional value to clients. Her leadership in professional development is crucial for maintaining high standards of service and fostering a culture of excellence. She is passionate about empowering employees to achieve their full potential and contribute to CreditCRB’s mission.

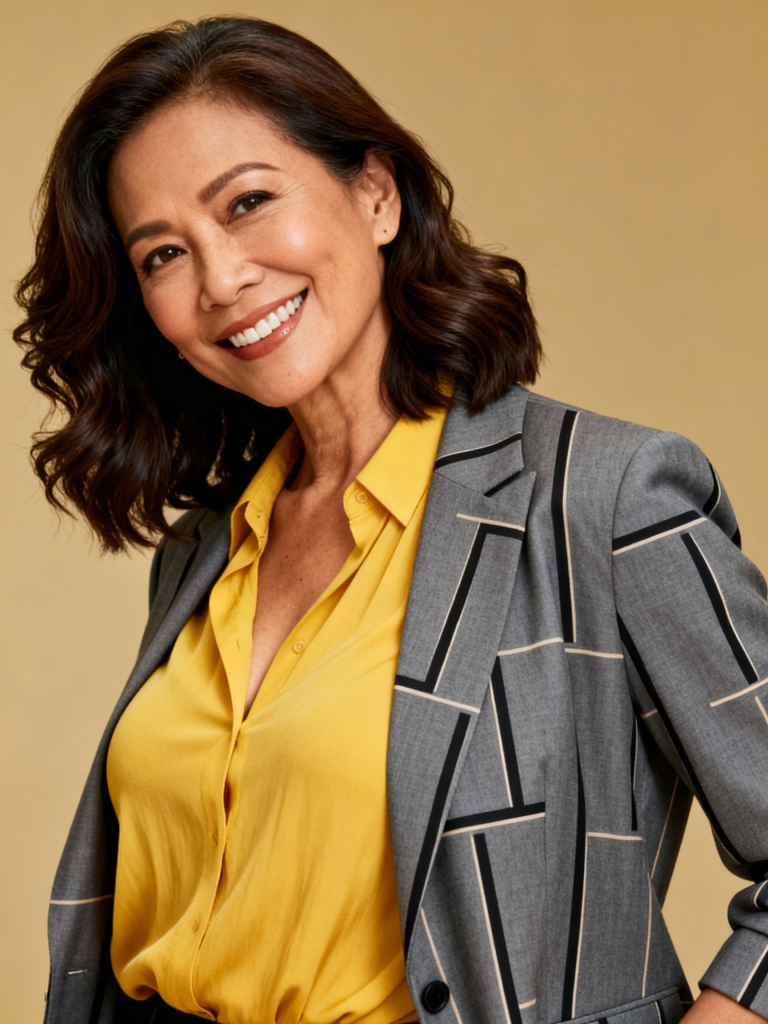

Karen Yeong

V.P of Analytics

Karen Yeong is the Vice President of Analytics at CreditCRB, leading the charge in transforming data into actionable insights that drive strategic decision-making. She is responsible for developing sophisticated analytical models and reporting frameworks that measure the effectiveness of CreditCRB’s services and identify opportunities for optimization. Karen’s expertise in data science and business intelligence provides critical foresight into market trends and client behavior. Her work ensures that CreditCRB remains agile and responsive to the evolving needs of its clientele. She is dedicated to leveraging data to enhance operational

Aly Garcia

V.P of Human Resources

Aly Garcia is the Vice President of Human Resources at CreditCRB, overseeing all aspects of talent management, employee relations, and organizational culture. She is responsible for attracting, developing, and retaining a diverse and high-performing workforce that embodies CreditCRB’s values. Aly’s strategic HR initiatives foster a supportive and engaging work environment, promoting employee well-being and professional growth. Her leadership ensures that CreditCRB remains an employer of choice, capable of delivering exceptional service to its clients. She is committed to building a strong, cohesive team that is passionate about empowering individuals and businesses financially.

Jenna Jorgensen

Jenna serves as the Vice President of Events and Trade Shows at CreditCRB, responsible for orchestrating the company’s presence at key industry gatherings and public outreach events. She designs and executes engaging event strategies that showcase CreditCRB’s expertise in credit repair and business financing, fostering valuable connections with potential clients and partners. Jenna’s meticulous planning and creative vision ensure that CreditCRB’s participation in events generates significant brand awareness and lead generation. Her efforts are crucial in expanding the company’s network and reinforcing its reputation as a thought leader. She is dedicated to creating impactful experiences that drive business growth and client engagement.

Yvonne Featherwood

V.P of Communications

Yvonne Featherwood is the Vice President of Communications at CreditCRB, responsible for shaping and disseminating the company’s message to internal and external stakeholders. She develops comprehensive communication strategies that articulate CreditCRB’s mission, values, and service offerings with clarity and impact. Yvonne’s expertise in public relations and corporate messaging ensures consistent and positive brand representation across all channels. Her leadership is vital in building and maintaining CreditCRB’s reputation as a trusted and authoritative voice in the financial services industry. She is dedicated to fostering transparent and effective communication that strengthens client relationships and enhances public perception.

Randi Ward

V.P Project Management

Randi Ward is the Vice President of Project Management at CreditCRB, playing a pivotal role in the successful execution of strategic initiatives and operational enhancements. She is responsible for leading complex projects from conception to completion, ensuring adherence to timelines, budgets, and quality standards. Randi’s strong organizational skills and ability to manage cross-functional teams are critical in driving efficiency and innovation within CreditCRB. Her expertise in project methodology ensures that the company consistently delivers impactful solutions that benefit clients and streamline internal processes. She is dedicated to fostering a culture of accountability and excellence in project delivery.

Bari Matsumoto

VP of Social Media

Bari Matsumoto serves as the Vice President of Social Media at CreditCRB, leading the company’s digital presence and engagement strategies across various platforms. She is responsible for developing compelling content and interactive campaigns that resonate with CreditCRB’s target audience, driving brand awareness and client acquisition. Bari’s expertise in social media marketing and community management ensures that CreditCRB effectively communicates its value proposition and connects with clients in meaningful ways. Her strategic approach to digital storytelling is crucial for building a strong online community and reinforcing CreditCRB’s reputation as an accessible and innovative financial partner. She is dedicated to leveraging social media to empower individuals and businesses with financial knowledge.

Maria Zeff

Executive Director of Procurement

Maria Zeff serves as the Executive Director of Procurement at CreditCRB, where she strategically manages the acquisition of all goods and services essential for the company’s operations. She is responsible for optimizing vendor relationships, negotiating contracts, and implementing efficient procurement processes that ensure cost-effectiveness and quality. Maria’s expertise in supply chain management and strategic sourcing directly supports CreditCRB’s ability to deliver its credit repair and financial services seamlessly and affordably. Her meticulous approach to resource allocation and vendor selection is crucial for maintaining operational excellence and supporting the company’s growth initiatives. She is dedicated to ensuring that CreditCRB’s internal infrastructure is robust and cost-efficient, ultimately benefiting clients through enhanced service delivery and competitive pricing.

John Chang

Executive Director of Debt Settlements.

Leadership Philosophy

Our leadership is guided by three core principles

Results First

Clients only pay when real progress is made

Integrity & Compliance

Ethical, lawful, and transparent processes

Client Advocacy

Every decision is made with the client’s best interest in mind